Regulators reached a secret deal with the biggest banks to water down a multibillion-pound scheme to compensate customers mis-sold complex interest rate derivatives blamed for bankrupting hundreds of businesses.

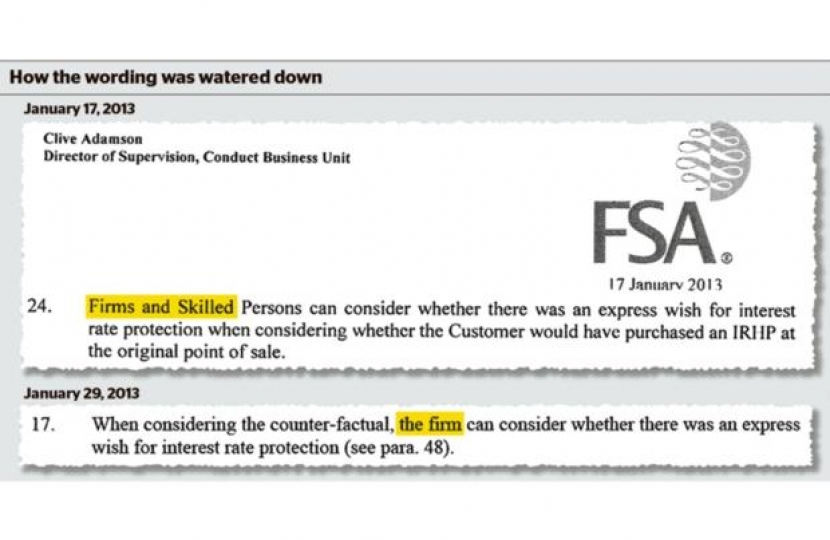

Documents seen by The Times show significant differences between the final rules for compensation schemes for victims of interest rate swap mis-selling and those put forward less than two weeks before.

Guto Bebb, the chairman of a parliamentary group supporting victims of swap mis-selling, said that the changes highlighted in the letters were “invariably in favour of the bank . . . It’s astonishing that the FCA continue to place so much confidence in the independent reviewers in view of a structure that allows banks to pick and choose what is presented for consideration.”

http://www.thetimes.co.uk/tto/business/industries/banking/article435136…